san francisco gross receipts tax instructions

Lean more on how to submit these installments online to comply with the Citys business and tax regulation. City and County of San Francisco.

California San Francisco Business Tax Overhaul Measure Kpmg United States

Your seven 7 digit Business Account Number.

. Failure to pay in full by the deadline will result in penalties interest and fees. Business Registration Renewal Instructions 2022-2023 All persons doing business in San Francisco must have a current business registration. If eligible based on your filing your refund will be processed automatically.

Your seven 7 digit Business Account Number. To avoid late penaltiesfees the returns must be submitted and paid on or before April 30 2021. City and County of San Francisco Office of the Treasurer Tax Collector 2020 Annual Business Tax Returns.

Gross Receipts Tax Applicable to Private Education and Health Services. Registration fees range from 56 to 40265 or 47 to 34514 for retailers wholesalers and certain services. These online instructions provide a summary of the applicable rules to assist you with completing your 2019 return.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. The san francisco office of the treasurer and tax collector recently issued gross receipts tax regulations tax return filing instructions and other guidance. The annual registration fee is based on San Francisco gross receipts for the immediately preceding tax year.

1 The existing payroll expense tax is being phased out in increments consistent with the phase-in of the gross receipts tax over a. Annual Business Tax Return Instructions 2018 The San Francisco Annual Business Tax Online Return Return includes the Gross Receipts Tax Payroll Expense Tax and Administrative Office Tax. Exclusions Tax Credits.

File Annual Business Tax Returns 2021 Instructions. ซอ เสอกฬา กางเกงกฬาขาสนผชาย รองเทาวงผหญง จาก Nike กบสนคาอกมากมาย ชอปงายๆ ราคาถกกวาใคร. San francisco gross receipts tax instructions Tuesday March 15 2022 Edit However the gross receipts of an airline or other person engaged in the.

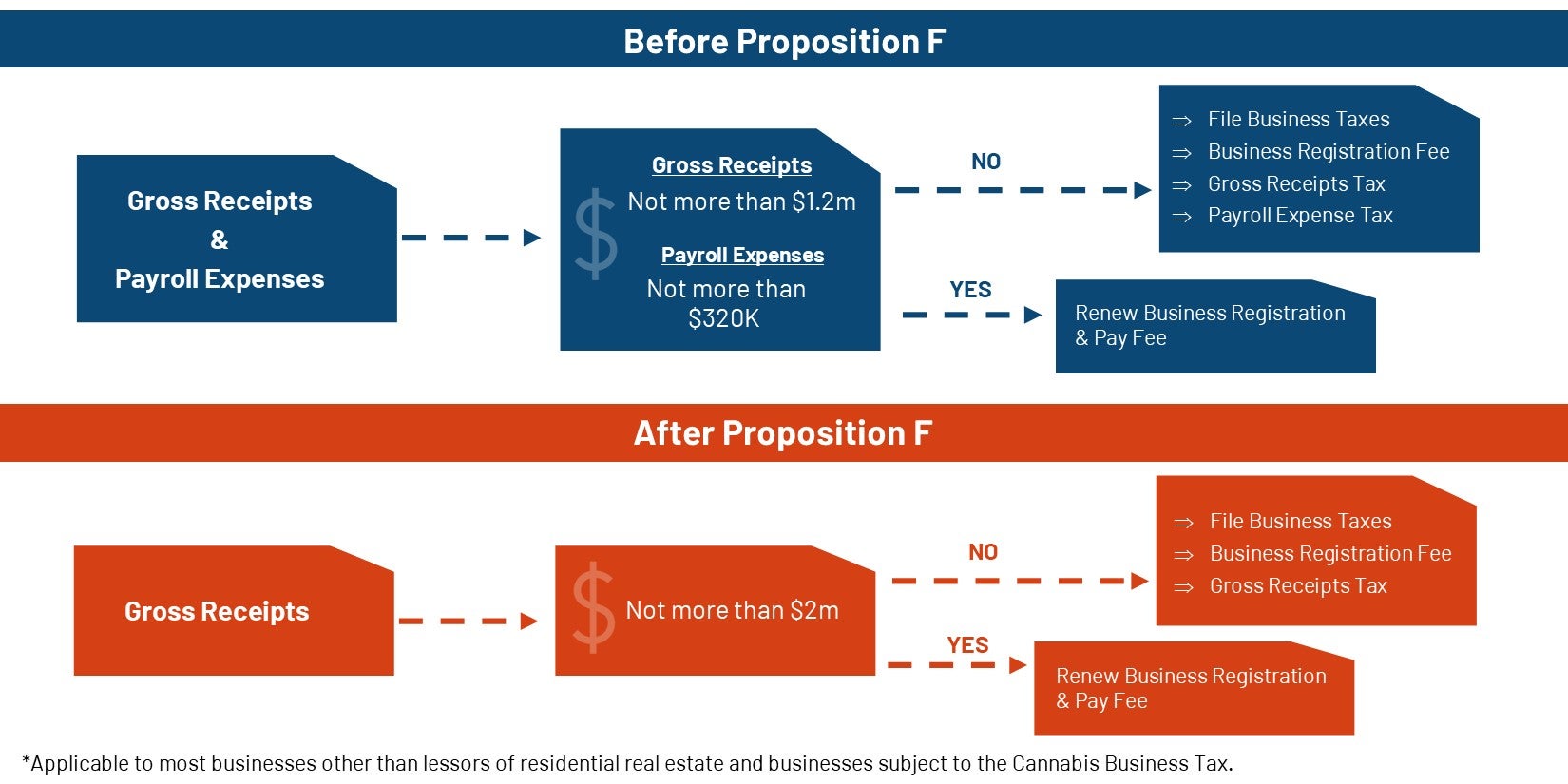

You ARE ENCOURAGED to file if your 2020 payroll expense was less than 320000 or gross receipts was less than 1200000 AND you made estimated quarterly payments toward 2020 San Francisco taxes as you may be eligible for a refund. Taxpayers should not consider these instructions as authoritative law. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

The San Francisco Business and Tax Regulations Code Code provides the law for computation and rules for filing the Return. 0300 percent for gross receipts between 0 and 1000000. To avoid late penaltiesfees the returns must be submitted and paid on or before February 28 2022.

The San Francisco Business and Tax Regulations Code Code provides the law for computation and rules for filing the Return. San Franciscos 2019 gross receipts tax and payroll expense tax. The last four 4 digits of your Tax Identification Number.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Go to 2023 Business Registration Renewal and login using the following information to renew your business registration. Tax Forms Tax Forms Irs Taxes Tax.

Who Must File When To File. San francisco gross receipts tax instructions Tuesday March 15 2022 Edit However the gross receipts of an airline or other person engaged in the. SAN FRANCISCO RESIDENTIAL RENT ASSISTANCE PROGRAM FOR PERSONS DISQUALIFIED FROM FEDERAL RENT SUBSIDY PROGRAMS BY THE FEDERAL QUALITY HOUSING AND WORK RESPONSIBILITY ACT OF 1998 QHWRA.

File Annual Business Tax Returns 2020 Instructions. In the 1970s the City added the payroll expense tax and allowed businesses to pay either the payroll tax or the gross receipts tax the so-called alternative method the constitutionality of which the City was later challenged for in court in 1999. File Annual Business Tax Returns 2021 Instructions.

To begin filing your 2020 Annual Business Tax Returns please enter. The progressive tax rate ranges between 01 to 06 and is assessed on gross receipts sourced to San Francisco as determined for Gross Receipts Tax purposes. San Francisco Tax Collector PO.

Businesses subject to the Administrative Office Tax are subject to a different fee and are discussed below. Beginning in tax year 2019 the Return will also include the Early Care and Education Commercial Rents Tax and Homelessness Gross Receipts Tax. The san francisco office of the treasurer and tax collector recently issued gross receipts tax regulations tax return filing instructions and other guidance addressing major changes to how owners.

Administrative and Support Services. Annual Business Tax Return Instructions 2021 The San Francisco Annual Business Tax Online Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. The San Francisco Office of the Treasurer and Tax Collector recently issued Gross Receipts Tax regulations tax return filing instructions and other.

Key Dates Deadlines Sf Business Portal

Overpaid Executive Gross Receipts Tax Approved Jones Day

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

San Francisco Adopts Major Changes To Business Taxes 2019 Articles Resources Cla Cliftonlarsonallen

Twitter San Francisco Headquarters Could Be In Play San Francisco Business Times

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

Annual Business Tax Returns 2019 Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

Renters Lease Agreement Real Estate Forms Rental Agreement Templates Room Rental Agreement Lease Agreement

San Francisco Gross Receipts Tax

Annual Business Tax Returns 2019 Treasurer Tax Collector

Oakland Voters Expected To Decide Business Tax Hike In November Here S What You Need To Know San Francisco Business Times

Treasurer Jose Cisneros Facebook